We all know that credit history is important because it’s how lenders, landlords, and sometimes even employers assess our creditworthiness. Anytime you apply for a loan or credit card, the lender will use your credit file to determine whether they think you are eligible for credit and what your interest rate will be.

But did you know that all credit is built from tradelines? Although this fact is not often discussed, it’s just as important to understand when it comes to building credit. Keep reading to find out why all credit begins with tradelines.

What Is a Tradeline?

Although building credit may seem complicated, it all comes down to properly managing your credit accounts, which are also called tradelines.

A tradeline is defined as any account that appears on your credit report. This includes both revolving accounts and installment loans.

Revolving accounts are accounts that can be used repeatedly without paying them off in full every month, so they may fluctuate in balance and minimum payment. Examples of revolving accounts include credit cards and home equity lines of credit.

An installment loan is a loan that is repaid over time with a set number of scheduled payments, e.g. a mortgage, auto loan, or student loan.

All of these different types of accounts are tradelines. Essentially, whether you have good or bad credit depends entirely on how you manage your tradelines.

Check out “What Is a Tradeline?” and our Tradelines 101 infographic for more tradeline basics.

What Goes Into Your Credit Report?

Although FICO and the credit reporting agencies keep the specifics of their credit scoring models a closely guarded secret, the general categories that factor into credit scores are widely known. In general, here’s what goes into a credit report, which is then used to calculate your credit score:

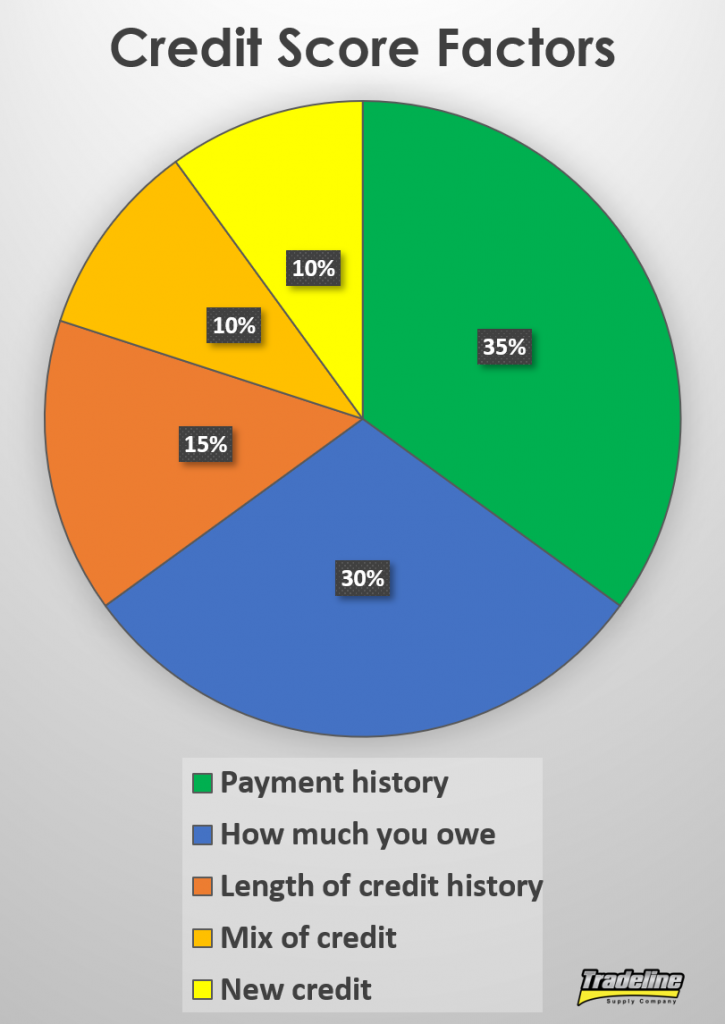

Credit scores are comprised of five main factors. (Click this image to pin to your Pinterest board!)

- Payment history, approximately 35%: Paying the amount due on your tradelines on time every month is extremely important. Late or missed payments could result in derogatory marks on your credit report that bring down your score. It’s a good idea to have several different tradelines that are in good standing since this category is weighted so heavily. If you do have a derogatory tradeline, it is important to maintain a perfect payment history on the rest of your tradelines to balance out the negative mark on your report. You always want your good credit history to outweigh the bad credit items.

- Utilization, or how much you owe, approximately 30%: Your utilization ratio is the ratio of how much you owe on all your revolving accounts (e.g. credit cards) to your total available credit, expressed as a percentage. Credit scores may consider both your overall utilization ratio and the utilization ratio of each individual tradeline. The lower your utilization, the better—it is generally recommended to keep your total utilization ratio below 30%, but having it lower than this is even better.

- Length of credit history, approximately 15%: This category considers factors like the average age of your tradelines, the oldest tradeline in your credit file, and the ratio of “seasoned” to non-seasoned tradelines. A seasoned tradeline is generally considered to be one that is at least two years old. Length of credit history goes hand-in-hand with payment history, together making up 50% of your credit score, so the age of your accounts is a powerful factor to consider.

- Credit mix, approximately 10%: Creditors want to make sure that you can manage different types of credit, so they look for a balanced mix of different tradelines in your report. The most important thing is to have tradelines in both of the two major categories: revolving credit and installment loans.

- New credit, approximately 10%: Credit scoring models take into account any new hard inquiries and new tradelines that you have added in the past 6 to 12 months. Generally, opening a new primary tradeline can have a temporary negative effect on your score, since it has no age and the person has not demonstrated their payment behavior on that account for very long.

Every major factor that goes into your credit file directly depends on your tradelines. Therefore, by adding authorized user tradelines, you can potentially affect each of these five factors.

Mismanaging your tradelines can lead to bad credit. Photo via CafeCredit.com.

There are a few things that could show up in your credit file that are not technically tradelines, such as collections, judgments, bankruptcies, and foreclosures. However, these bad credit items can all be thought of as the result of not properly managing your tradelines. Let’s examine each example.

- A collection occurs when you have not been making payments on a tradeline and the creditor sells your debt to a collection agency.

- A judgment against you happens when you default on a tradeline and a judge orders you to pay back the debt.

- You might declare bankruptcy if you cannot pay off your tradelines and need to be released from the legal requirement to pay them.

- Foreclosure is when a mortgage lender takes possession of the mortgaged property when the borrower fails to make payments on the mortgage tradeline.

How to Build Credit

The best way to build a good credit record is to open a variety of tradelines and keep them in good standing by making payments on time and keeping the utilization low. We delve more into exactly how to optimize each factor of your credit score to get the best score possible in “How to Get an 850 Credit Score.”

The simple fact of the matter is that you cannot build credit without tradelines.

Opening a credit card is a common way to establish a credit file and start building credit, but it is not the only option. Other paths to building credit include taking out student loans, auto loans, or credit-builder loans.

Parents often add their children as authorized users to their credit cards to help them establish credit early.

Unfortunately, building credit is often considered a “catch-22” because lenders are hesitant to provide credit to those with no credit history, so it can seem like it takes credit to get credit.

To overcome this obstacle, many people rely on the positive credit history of others to establish their own credit file.

The Consumer Financial Protection Bureau estimates that about 25% of consumers first acquire credit history via an account on which someone else was also responsible. Some of these consumers open a joint account with a co-borrower, while others become authorized users on someone else’s primary tradeline.

These examples are all cases of what is called credit piggybacking.

As another example of this, parents are commonly advised to add their children as authorized users to their credit cards in order to help them establish a positive credit history early in life. In fact, it is estimated that about 20-30% of Americans have at least one authorized user tradeline in their credit file.

Unfortunately, many people do not have the same opportunity to benefit from a family member’s authorized user tradelines. Studies have shown that minorities and lower-income demographics are less likely to have authorized user tradelines, which means they are likely to face difficulty in establishing a credit history.

We are proud to help reduce financial inequality by providing equal opportunities to those who may not have a friend or family member who can provide the benefits of an authorized user tradeline.

Tradelines and Your Credit

It is crucial to be knowledgeable about credit since credit is such an integral part of your financial well-being. Since all credit is essentially built on tradelines, it is equally important to understand the way tradelines may affect your credit.

Sometimes gaining access to tradelines can be a challenge for people who are either new to credit or who have had problems in the past and are trying to re-establish their credit.

Traditionally, some people have had the privilege of relying on family and friends to help share credit, but new innovations have created equal opportunities for those who may not have the same opportunity. We are proud to provide quality tradelines for sale at affordable prices at TradelineSupply.com.

Were you surprised to learn that all credit is built from tradelines? Let us know by leaving a comment!